The Election Impact on Mortgage Markets

During the recent election uncertainty, mortgage markets have been relatively steady. This is likely a result of investors expecting government control to be divided between the Democrats and the Republicans. For mortgage markets, a divided government typically is...

30 or 15 year mortgage…which to choose?

One of the few good things we can all point to in 2020 is that this year's lowest mortgage rates have provided homeowners incredible savings through refinances. If you own a home and have a 30-year mortgage that could benefit from a refinance, your first thought might...

Looking to refinance? Find out how much equity you have in your home.

Rates are at or near an all-time low...so refinancing your loan might be a great move. One of the important steps of refinancing is to determine how much equity you have in your current home. Home equity is the value of your ownership stake in your home. It is...

Is your credit ready for a refinance?

Rates are currently low and refinancing your mortgage might be right for you and your family. Part of the refinance process involves your lender looking at your credit score. If you’ve improved your credit and finances since initially buying your home, this can help...

Unemployment is down as the recovery continues

Last week's economic data was pretty much what we expected. President Trump's positive coronavirus test was a little positive for mortgage markets but negative for stocks. Mortgage rates ended the week with very little change. Friday's monthly labor market report...

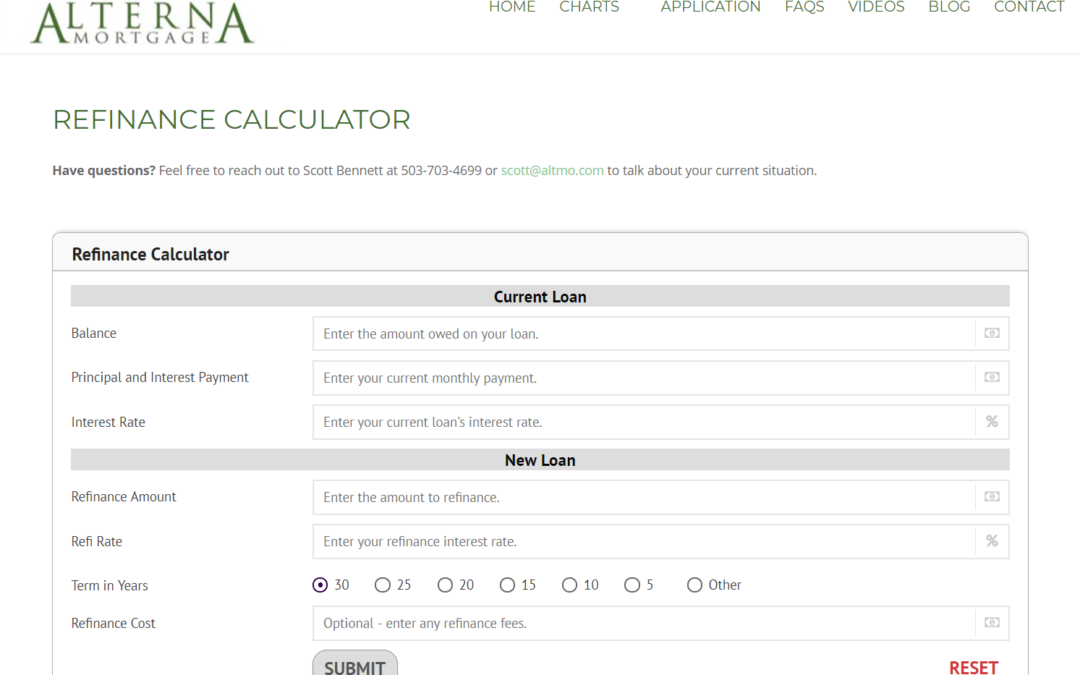

Announcing our Refinance Calculator

There are a lot of great reasons to refinance your home mortgage. To help you decide if it is the right decision for you, we have added a Refinance Calculator to our website. Why would you want to refinance? Lowering your interest rate Known as a “rate-and-term”...

Considering a refinance? Here is a checklist to get you ready.

Buying a house is likely one of the most important decisions you have ever made. If you still love your home, but not your mortgage rate, you might want to consider refinancing now while interest rates are so low. Refinancing gives you the opportunity to exchange your...

Fed Will Keep Rates Unchanged

Federal Reserve officials are expected to leave interest rates near zero for the foreseeable future — likely through at least 2023. This means they will put up with periods of higher inflation in an effort to revive the labor market and economy. The announcement last...

Why should you work with a mortgage broker?

Working with Alterna Mortgage is better than working with a bank. Pros of working with Alterna Mortgage We do all the legwork for you, working on your behalf with the lender We compare wholesale mortgage rates from a large number of banks and lenders all at once We...

Some frequently asked questions

As the summer homebuying season begins to wind down, here are some frequently asked questions. What is private mortgage insurance? Private Mortgage Insurance (PMI) is to protect the mortgage lender if a loan defaults. It is required if the loan amount is more than 80%...