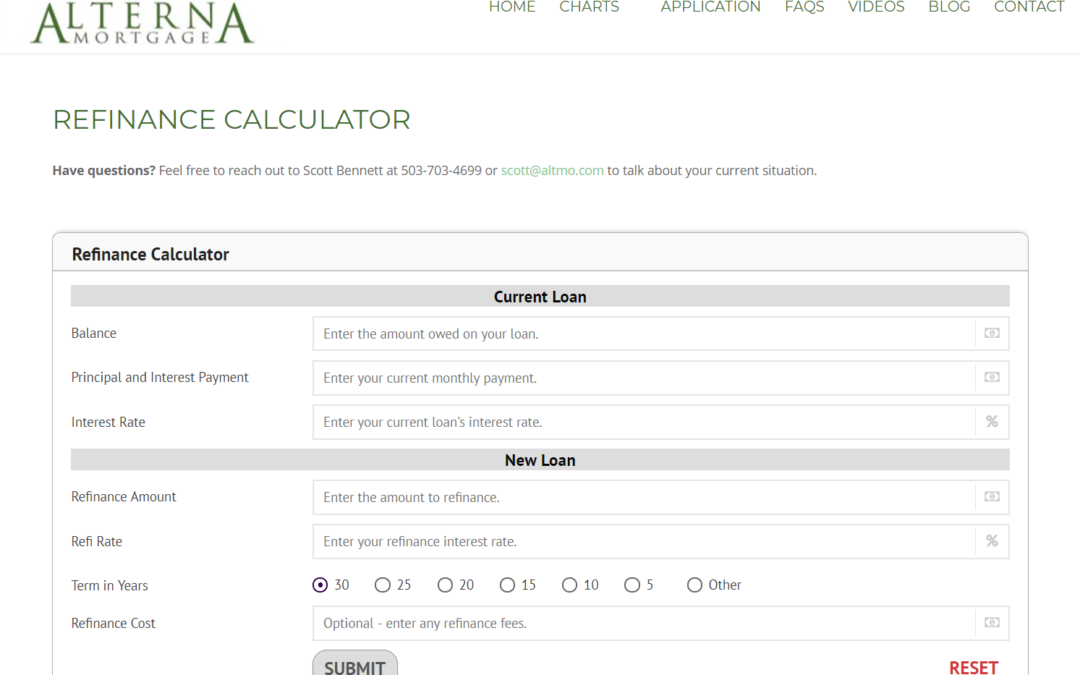

There are a lot of great reasons to refinance your home mortgage. To help you decide if it is the right decision for you, we have added a Refinance Calculator to our website.

Why would you want to refinance?

Lowering your interest rate

Known as a “rate-and-term” refinance, this is the most popular reason homeowners refinance a home loan. Homeowners with a higher interest rate on their current loan may benefit from a refinance if the math pans out — especially if they’re shortening their loan term. Shorter-term mortgages typically have lower interest rates than longer-term mortgages because you’re paying back the loan in less time.

Consolidating your debt

If you have a hefty amount of high-interest debt on credit cards or personal loans, a cash-out refinance may help improve your cash flow and save you money in the long term, possibly even if you take a slightly higher mortgage rate.

Getting rid of your mortgage insurance

If you have a home loan with private mortgage insurance (PMI), a refinance could help lower your monthly costs. This is especially true if you have a loan insured by the Federal Housing Administration, or FHA. While FHA loans can be a viable path to homeownership for borrowers with little savings or not-so-stellar credit, they come with a big downside: mandatory mortgage insurance. To eliminate PMI, homeowners can refinance an FHA loan into a conventional mortgage once they gain 20 percent equity in their home.

Recent Comments