by Alterna Mortgage | Jan 28, 2021 | Credit, Financing, Interest rates, Real Estate, Refinancing

As we said before, those Christmas credit card bills are starting to roll in. As a result of Christmas 2020, you may find that you have a sizable amount of high-interest credit card or personal loan debt. A cash-out refinance can improve your cash flow situation and...

by Alterna Mortgage | Dec 3, 2020 | Financing, Housing Market, Mortgage Programs, Real Estate

The Federal Housing Finance Agency recently announced a new baseline conforming loan limit for Fannie Mae and Freddie Mac in 2021: $548,250. This means that you can now borrow an additional $38,150. This can get you a house with more square footage, more land, better...

by Alterna Mortgage | Sep 29, 2020 | Interest rates, Real Estate, Refinancing

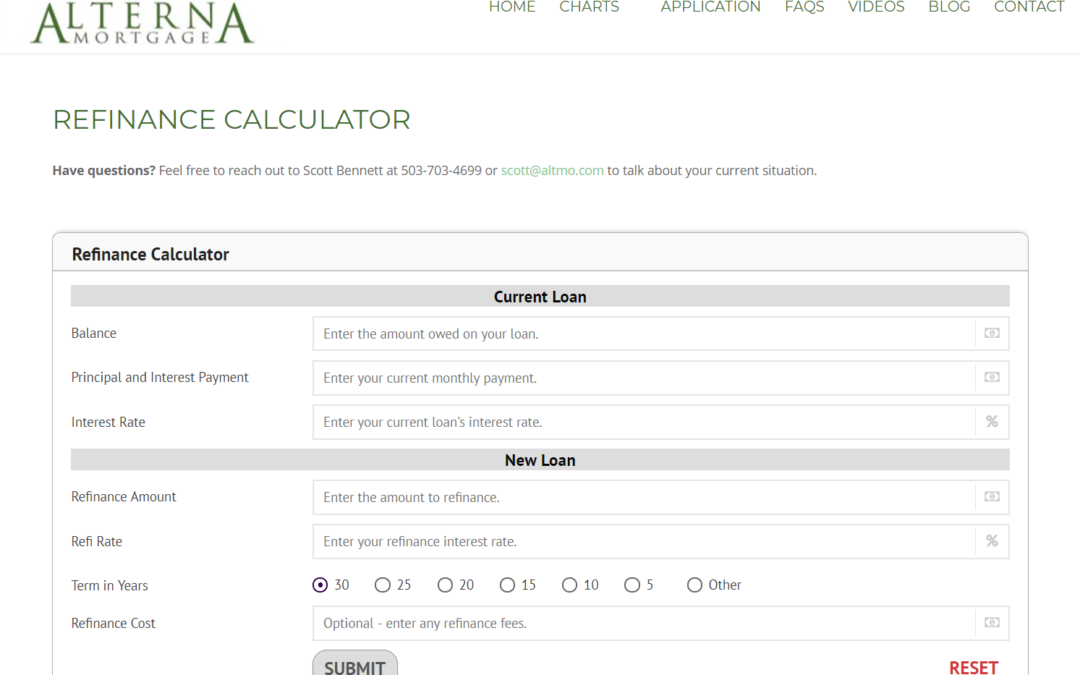

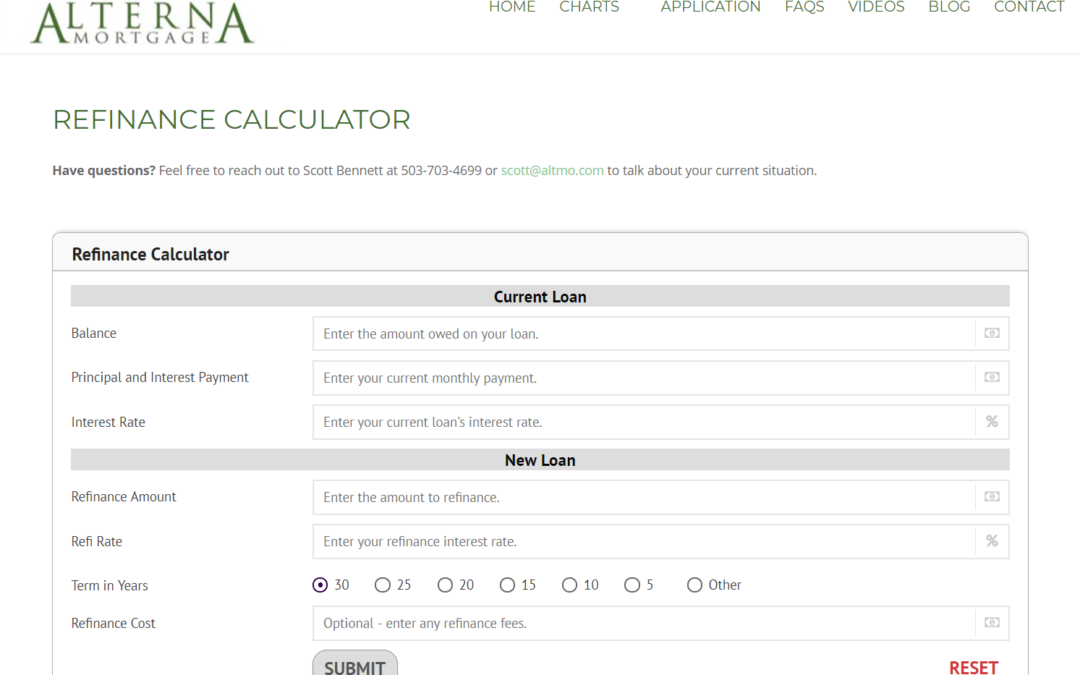

There are a lot of great reasons to refinance your home mortgage. To help you decide if it is the right decision for you, we have added a Refinance Calculator to our website. Why would you want to refinance? Lowering your interest rate Known as a “rate-and-term”...

by Alterna Mortgage | Sep 28, 2020 | Financing, Interest rates, Real Estate, Refinancing

Buying a house is likely one of the most important decisions you have ever made. If you still love your home, but not your mortgage rate, you might want to consider refinancing now while interest rates are so low. Refinancing gives you the opportunity to exchange your...

by Alterna Mortgage | Aug 3, 2020 | Housing Market, Interest rates, Mortgage Programs, Real Estate

The notion that summertime prices are always the highest prices is a myth. The truth is that there are a number of factors that determine home pricing such as summer slowdown at the office, fluctuating interest rates, general economic health, and this year: COVID....

by Alterna Mortgage | Jul 28, 2020 | Credit, Housing Market, Interest rates, Real Estate

Save for a Down Payment It’s generally common to put 20% down, but first-time home buyer programs allow as for much less. Keep this in mind: putting down less than 20% may mean higher costs and paying for private mortgage insurance. Check Your Credit Your credit will...

Recent Comments